When Will Amazon Spilt Its Stock Again

Daria Nipot/iStock Editorial via Getty Images

Article Thesis

Amazon.com, Inc. (NASDAQ:AMZN) is a leading high-growth retail and tech giant that is very well-positioned for the long run, we believe. In the past, we have argued that Amazon was, despite its above-boilerplate valuation, a solid long-term investment.

Reader interest made us wait at the possibility of a stock dissever, and the potential pros and cons of that. Nosotros will lay out our findings on that in this report. Overall, a stock divide does not seem overly probable in the firsthand future, fifty-fifty though there would be some advantages to that.

When Was Amazon's Last Stock Dissever?

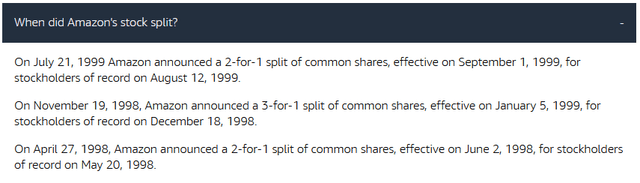

Amazon.com, Inc. has split up its stock in the past, the company's investor relations website shows the following splits:

Source: Amazon

With three recorded stock splits in a fiddling over a year, Amazon was very active when it comes to stock splits during the tardily 1990s. That was, of course, the time of the dot.com chimera, when shares of tech companies such equally Amazon had performed extremely well. Massive share toll increases, oftentimes fueled by speculation and non by underlying growth, allowed Amazon and others to split its shares repeatedly. With two 2-for-1 splits and one 3-for-i split, each original share of Amazon, which had its IPO in 1997, turned into 12 shares of the company past August 1999. Since then, however, Amazon has not split its stock again, despite massive share cost gains over the final couple of years, and despite the fact that more than 22 years have passed since the last stock dissever.

Why Hasn't Amazon Stock Split Recently?

The short respond is that management has not felt the need for a stock split, which is why they oasis't done one in quite some fourth dimension. This, of course, brings up the question of why direction has decided against further stock splits despite the fact that they seemingly were a big fan of them in the belatedly 1990s.

One reason for Amazon to not do any stock splits is that fractional share buying has go the norm in recent years, which is why there is less need for regular stock splits from well-performing stocks. In the past, when investors could only purchase whole shares, too-high share prices meant that some investors were not able to invest in companies with high share prices, which ways that the biggest reason for companies to split up their shares was to keep the cost in an adequate range that immune enough investors to buy the stock. With Robinhood Markets (HOOD) and others making fractional share buying the norm in the recent past, however, everyone can buy into Amazon today -- the high share cost is no longer a barrier to entry for new investors.

This does not mean that management is completely confronting stock splits, however. Amazon'due south former CEO Jeff Bezos has stated, in 2017, the following, when asked nigh a potential stock separate:

That's something we consider from time to fourth dimension. We don't have any plans to do that at this point, but nosotros will continue looking at information technology.

This does not sound like deprival, but rather similar a "we'll do that when the fourth dimension is right and we have the focus for it" to me, thus investors might come across a stock split in the coming quarters or years.

Is An Amazon Stock Divide Practiced For Investors?

Theoretically, the value of the company does not modify when a company does a stock split. Each individual owns the same portion of the overall company earlier and after a stock dissever, all else equal -- whether you lot own ten out of 1 million shares, or 20 out of 2 meg shares, does non make a departure when it comes to your stake in the company.

There are, notwithstanding, some other factors at play that could still make a stock separate beneficial for shareholders. Commencement, a stock separate could improve liquidity for Amazon'south shares. Since Amazon is a very large company that is traded a lot, liquidity isn't a major issue, but with even better liquidity, investors might become meliorate entry and get out prices, all else equal.

A stock separate would also effect in index inclusion in the Dow Jones, I assume. Amazon is currently not included, since the DJIA (DIA) is cost-weighted, which is why companies with very high stock prices, such as Amazon, can't be included without the index getting distorted. If Amazon were to split its shares at a rate of x-to-1, for case, information technology could get included, yet. This would lead to some buying by ETFs that replicate the alphabetize, thereby boosting demand for Amazon's shares. Apple (AAPL), for case, got included in the DJIA following its vii-for-1 split in 2014, which brought the share price to an adequate level.

A stock split would besides make pick usage easier for investors. An selection contract covers 100 shares, which means that 1 option contract covers a $350,000 investment at electric current prices. This ways that using strategies such as covered call writing to generate some extra income, or selling cash-secured puts to enter positions at better prices, is more or less incommunicable for most when information technology comes to Amazon. Most investors don't have portfolios that are large enough to warrant unmarried positions in the hundreds of thousands of dollars, preventing about from using options. A stock split could change that, possibly making Amazon more bonny for those that similar to employ option strategies.

Last merely not least, it should also be mentioned that stock splits can atomic number 82 to some (probable irrational) short-term price upside. In 2020, when Apple and Tesla (TSLA) split their stocks, both experienced significant share price gains in a short period of fourth dimension. That wasn't driven by fundamentals, but rather past speculation or misunderstanding of what a stock divide means, I believe, but yet, investors saw their investments gain in value. The aforementioned could happen if Amazon splits its shares, although that is not guaranteed, of form.

The biggest reason for stock splits in the by, keeping the toll at a level that allows everyone to buy into the company, is no longer valid, as partial share buying is possible through most brokers. But still, stock splits can have some advantages, such equally improving liquidity, allowing for index inclusion, and making selection usage easier. I thus believe that a stock split would exist a positive for Amazon's shareholders.

Is AMZN Stock A Purchase, Sell, Or Hold?

Amazon is a high-growth tech company with a huge moat and a great market position in both its core retail concern and in the cloud computing space. On top of that, both of these core markets, i.east. cloud computing and online shopping, continue to grow at an attractive footstep, and will probable practise so for many years to come. This naturally results in a quite positive long-term growth outlook, although information technology should be noted that Amazon will not exist able to grow at a 20%-30% rate forever. The law of big numbers dictates that growth will inevitably wearisome down over the years.

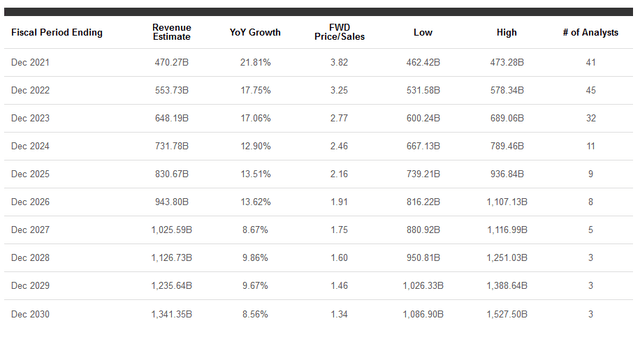

Analysts are, nevertheless, predicting compelling business growth throughout the next decade:

Source: Seeking Alpha

Growth is seen slowing from 22% this yr to a high-teens range in 2022 and 2023, before moderating towards 9%-fourteen% throughout the remainder of the decade. Overall, the electric current consensus still sees AMZN growing at a 13% rate betwixt 2020 and 2030, which is quite bonny. Due to the fact that higher-margin businesses such equally subscriptions and cloud computing are growing at in a higher place-average rates, AMZN's margins should ascension over time. Fixed cost digression/operating leverage should further accelerate Amazon's earnings growth, which is why AMZN'south earnings per share should abound by a lot more than 13% a yr going frontwards.

Current analyst estimates see Amazon earning $240 per share in 2027 (run across Seeking Alpha site linked to a higher place), which represents a steep half dozen-fold increase versus current estimates for 2021. If Amazon were to trade at 22x net earnings in 2027, which would exist comparable to how the wide market is valued right now (based on SPY EPS estimates for 2022), shares could climb to $five,300 over the next 6 years, which would permit for returns of ~vii% a yr. That would be far from bad, just information technology wouldn't be outstanding, either. If Amazon were to merchandise at 25x net profits in 2027 -- a premium valuation could be warranted thanks to a huge moat and an attractive industry -- returns could average 9% a yr for the next 6 years.

It is, of form, possible that Amazon outperforms expectations, or that electric current annotator projections are too optimistic. Notwithstanding, these scenarios indicate that returns in the 6%-10% a yr range seem relatively realistic, I believe. Amazon should thus be a solid performer, but investors will likely non come across the returns they take seen over the last couple of years. I do believe that, based on the current return outlook and the solid quality of the company, Amazon is a compelling long-term investment, although I exercise not program to add together at electric current prices. I would thus rate the stock a Hold for now.

This article was written past

The Investment Customs where "Greenbacks Menstruum is King"

Co-ordinate to Tipranks, Jonathan is among the top ii% of bloggers (equally of July 19, 2019: https://world wide web.tipranks.com/bloggers/jonathan-weber).

If you want to reach out, you can send a direct message here on Seeking Blastoff, or an electronic mail to jonathandavidweber@gmail.com.

Disclosure:

I work together with Darren McCammon on his Marketplace Service Cash Flow Kingdown.

Disclosure: I/we have a benign long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and information technology expresses my own opinions. I am non receiving bounty for it (other than from Seeking Alpha). I have no business relationship with whatsoever company whose stock is mentioned in this article.

Source: https://seekingalpha.com/article/4470299-amazon-stock-split

0 Response to "When Will Amazon Spilt Its Stock Again"

Post a Comment